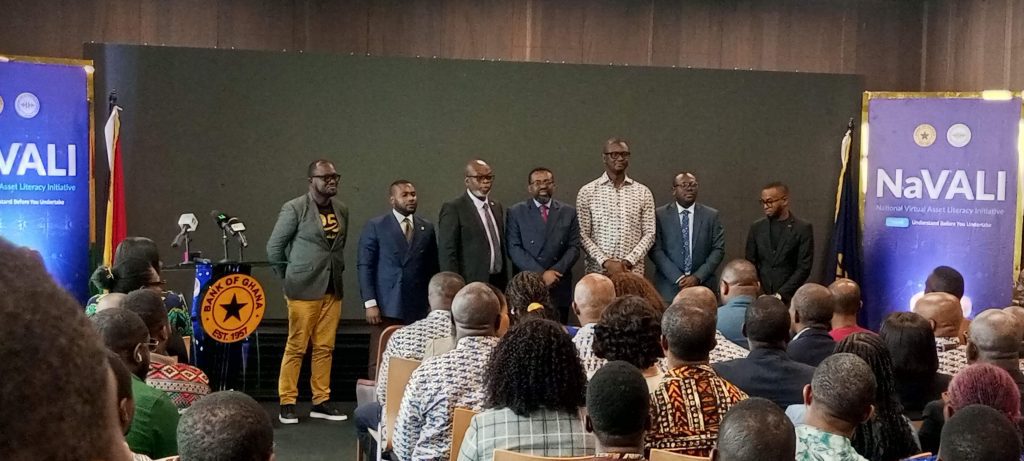

The Bank of Ghana (BoG) has launched the National Virtual Asset Literacy Initiative (NaVALI), a nationwide programme aimed at equipping consumers, institutions, and market participants with the knowledge needed to engage safely, responsibly, and lawfully in Ghana’s growing virtual asset space.

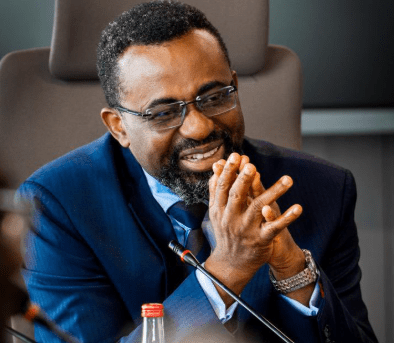

The initiative was officially launched at The Bank Square in Accra by the Governor of the Bank of Ghana, Dr. Johnson Pandit Asiama, who described NaVALI as a critical pillar in building a secure and resilient digital economy.

Dr. Asiama said the launch follows the enactment of the Virtual Asset Service Providers (VASP) Act, which he described as “a significant milestone in Ghana’s financial sector development.” Under the Act, the Bank of Ghana and the Securities and Exchange Commission (SEC) have been designated as regulators responsible for overseeing virtual asset activities in the country.

“The Bank of Ghana and the Securities and Exchange Commission are currently focused on establishing the requisite structures, systems, and processes to ensure the timely and orderly operationalisation of the Act,” the Governor stated.

While outlining Ghana’s regulatory roadmap, Dr. Asiama stressed that enforcement alone cannot guarantee a safe virtual asset ecosystem, noting that all stakeholders must be adequately informed.

“Effective regulation and enforcement cannot be achieved by regulators alone,” he said, adding that the entire ecosystem must be prepared “through a sound understanding of virtual asset activities, their implications, and the associated risks.”

It is against this background, he explained, that NaVALI was developed, anchored on what he described as a simple but powerful principle: “Understand before you undertake.”

According to the Governor, the initiative positions virtual asset literacy as the foundation for a safe digital economy, especially at a time when interest in cryptocurrencies, blockchain-based platforms, and other digital assets continues to grow rapidly, particularly among young people and online workers.

Dr. Asiama explained that NaVALI is a carefully designed initiative led by the Bank of Ghana in collaboration with the SEC, academia, and industry partners, and guided by two main policy objectives.

The first, he said, is to strengthen institutional capacity in virtual assets and enabling technologies such as blockchain, to support effective regulation, supervision, and policy formulation.

The second objective is to promote nationwide awareness of the risks and implications of virtual assets “in order to discourage uninformed usage and risky adoption.”

These goals align with NaVALI’s broader mission to empower consumers, build confidence in digital finance, and reduce exposure to fraud, scams, and speculative losses that often accompany poorly understood digital investments.

The Governor acknowledged that innovation in the virtual asset space is evolving rapidly, making education and public awareness indispensable.

“As innovation in the virtual asset space continues to evolve, education and awareness must remain central to our regulatory approach,” he said.

Dr. Asiama described NaVALI as “a proactive and collaborative effort to ensure that innovation progresses responsibly,” while safeguarding consumer protection, market integrity, and financial stability.

He commended the Bank of Ghana’s virtual assets team, the SEC, and knowledge partners for their contributions, noting that their collaboration reflects a shared responsibility to build “a resilient and well-informed virtual asset ecosystem in Ghana.”

NaVALI is the first national programme of its kind in Ghana and is expected to support broader financial inclusion and digital transformation efforts by ensuring that citizens are not left behind as new financial technologies emerge.

“It is with great pleasure that I officially launch the National Virtual Asset Literacy Initiative, NaVALI,” Dr. Asiama declared.

The programme is expected to roll out through structured education, stakeholder engagement, and public awareness campaigns, as Ghana positions itself to harness innovation while protecting consumers in the rapidly expanding digital financial landscape.